C

ComputerHelp_Microsoft

Guest

TurboTax Not Working Call ((+1-828-668-2992))

Fix TurboTax Not Working Problems In Windows Operating System.

TurboTax is an American tax preparation software package developed by Michael A. Chipman of Chipsoft in the mid-1980s. Intuit acquired Chipsoft, based in San Diego, in 1993. Chipsoft, now known as Intuit Consumer Tax Group, is still based in San Diego, having moved into a new office complex in 2007.

How To install the TurboTax software for Windows?

Installing TurboTax is easy. Start by closing all programs, including any firewall and virus-protection programs (remember to turn those back on after installation is complete).

If you downloaded your TurboTax software, simply double-click the downloaded file to launch the installer. Find your download.

Otherwise, insert the CD into your computer's CD drive (unless your computer doesn't have one) and the installation should start automatically. If it doesn't:

- Hold down the Windows+R keys to open the Run window.

- Click Browse, and then navigate to the TurboTax CD on your CD/DVD/RW drive (usually Drive D).

- Double-click the setup.exe file.

- Click OK to launch the installer.

How To download TurboTax?

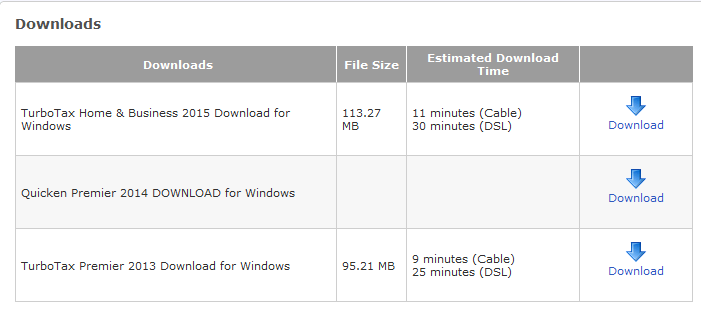

After you've purchased a downloadable product through TurboTax.com, you can download it whenever you like up to 3 years after purchase.

- First Go To www.turbotax.com Then Sign in to My Downloads.

- Click the blue Download arrow for the product you would like to download.

- Save the download somewhere on your computer where you can find it – your desktop is a good place.

- After the download has finished, install your software by double-clicking the downloaded file.

How To Correct Federal Tax Return

Overview

You do your best to file a correct tax return. You gather all your W-2s, 1099s, receipts and other documents and navigate through all of the knowledge to seek out the proper schedules and forms. Sometimes, however, new data arises once you file your return. perhaps you discovered a step-down you did not notice you qualified for, or lost a 1099 kind as a result of it came in late. fortuitously, the office features a easy method in situ that permits you to amend your return.

Step one - Gather all new tax documents

This includes any new 1099 or W-2 you receive if you under-reported your financial gain. If you're claiming a replacement deduction or credit, any document that supports your eligibility to assert it like a receipt are useful. it is also an honest plan to own a replica of your original return accessible.

Step two - kind 1040X

Download a replica of office kind 1040X, Amended U.S. taxation come. this can be the sole kind you'll use to amend a private return. you'll simply realize it mistreatment the search perform on the TurboTax web site.

If you originally filed your come with TurboTax, we will assist you amend it.

Step three - determine the error or modification you would like to form

If you're correcting a mistake on your original return, you may would like a blank copy of that individual kind from a similar year. can|this may|this can} enable you to cypher your tax and to examine that numbers on the initial return will amendment as a results of the modification. you'll realize office forms from previous years mistreatment TurboTax's prior-year returns perform, otherwise you will search through the office web site for it.

Step four - transfer and prepare new schedules and attachments

When you prepare associate degree return, the office solely needs you to update figures that amendment. It does not need you to complete a complete return. However, if any of the initial schedules you filed can amendment owing to your modification, then those schedules should be ready once more and hooked up to your kind 1040X.

Step five - Fill out kind 1040X in keeping with the directions

Write a transparent rationalization of your reasons for filing the shape 1040X. Attach all forms you're amending along side any new supporting documentation and mail them to the address provided for your location within the kind 1040 directions. this may be a similar office service center that processed your original taxation come. embody a payment for any further tax due. If you do not embody the payment, the office might assess interest and penalties on the unpaid balance.

Filing associate modification with TurboTax

If you filed your original come with TurboTax on-line, merely log in to your account and choose “Amend a come that was filed and accepted.” If you used our CD/download product, sign back to your come and choose “Amend a filed come.”

How To File Tax Return With IRS

Step1 Collect your documents

Gather your original come back and every one new documents. you may got to reference your original {tax come back|income tax return|return|legal document|legal instrument|official document|instrument} and any documentation that relates to your modification like proof of a brand new deduction you're claiming or a W-2 you did not have once making ready the initial return. If you're missing a W-2, you'll be able to file a type 4852 and have the Internal Revenue Service issue a W-2 replacement as long as your leader provided the Internal Revenue Service with this info.

Step 2: Get the correct forms along

Download the required forms for the tax year you're amending. The Internal Revenue Service maintains a information on its web site wherever you'll be able to access all tax forms for previous years. or else, you'll be able to use TurboTax to file your modification – we’ll mechanically realize and fill within the forms you wish.

Remember that you simply do not got to submit new forms for your entire return, simply the aras that are affected. for instance, if you originally ready a Schedule B to report interest financial gain, amending your come back to assert a charitable contribution deduction (which isn't rumored on Schedule B) won't have an effect on it. However, it'll need you to organize a brand new Schedule A to report the charitable contribution along with your itemized deductions.

Step 3: Fill out a 1040X

Download a current Internal Revenue Service type 1040X, Amended U.S. Individual tax come back. TurboTax will facilitate with this. the shape includes easy-to-follow directions and solely needs you to incorporate new or updated info. it's extra to repeat info from your original come back. you may additionally realize an area wherever you'll be able to write a proof on why you're amending your come back.

Step 4: Submit your income tax return

Send the Internal Revenue Service your income tax return. Before mailing your come back to the Internal Revenue Service, countercheck that you've got hooked up all necessary forms and supporting documents. within the event your modification leads to a better bill, you must embrace the extra tax payment with the come back. By creating a payment, you'll be able to minimize the quantity of interest and penalties you will be subject to since technically, you're creating a late payment of tax. It takes the Internal Revenue Service eight to 12 weeks to method your modification, therefore provides it it slow before you contact them concerning your income tax return.

TurboTax General Errors And Fix

- 1312 Error : Is for folder

- 1316 Error: MSI Install Exception occurred

- 1324 Error: Invalid character

- 1327 Error: Windows Installer cannot write to the specified drive

- 1334: Error Installing C:\Program Files\Common Files\Intuit\TurboTax

- 1335 Error: Cabinet file is corrupt

- 1406 Error: Could not write value to key

- 1601 Error: Windows Installer service could not be accessed.

- 1603 Error: Fatal error during installation.

- 1604 Error: Installation suspended, incomplete.

- 1605 Error: Unable to flush wrapper.msi

- 1606 Error: Could not access network location

- 1612 Error: Installation source not available

- 1618 Error: Another installation is already in progress.

- 1621 Error: Error starting the Windows Installer service user interface.

- 1622: Error opening installation log file.

- 1625:Error Installation is forbidden by system policy...

- 1631: Error Windows Installer service failed to start...

- 1632: Error The temp folder is either full or inaccessible.

- 1633: Error Installation package is not supported on this platform.

- 1635: Error This update package could not be opened...

- 1640: Error Installation from a Terminal Server client session not permitted...

- 1719: Error Windows Installer not accessible

- 1935: Error An error occurred during the installation of assembly

- 20888-series errors

- 2203: Unexpected error installing package

- 2350: Microsoft Installer error

- 25015: Failed to install assembly...

- 2720: Microsoft Installer error

- 4098: Installation of Windows Installer components failed.

- 4099: Windows Installer is not installed properly...

- 4101: Another instance of setup is already running.

- 4113: Beta NDP components detected.

- 4121: One or more prerequisites for this product is missing.

- 65535: Unexpected error

- 8191: Setup failure—unknown reason

- 8192: Reboot is required.

TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working

TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working

TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working

TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working

TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working

TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working | TurboTax Not Working

Continue reading...